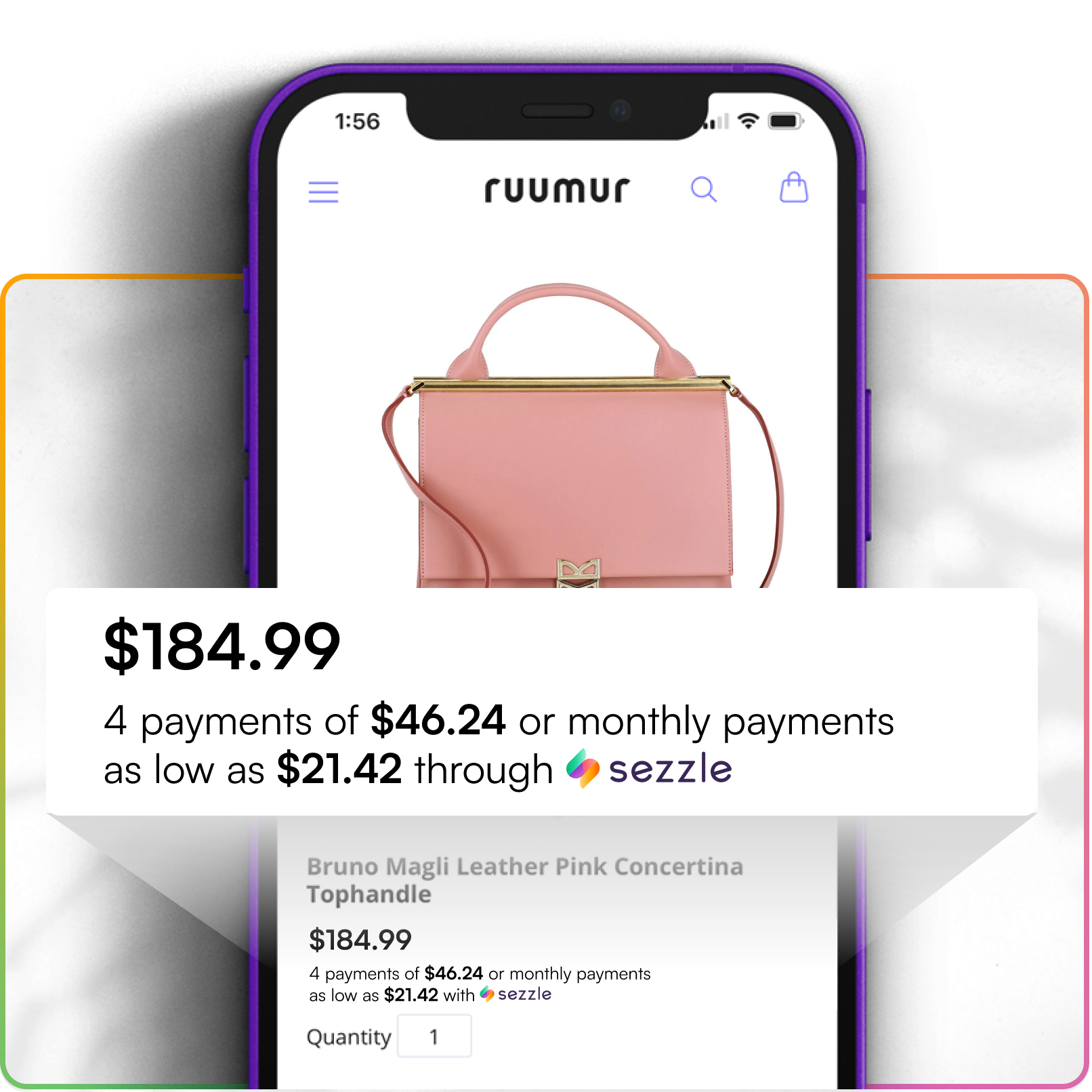

Buy Now Pay Later with the Sezzle App

Shop in-app or in-store, and buy now pay later in 4 easy installments over 6 weeks & no interest.¹

Sezzle It: Buy Now Pay Later with No Interest!

Tap into a new way to get what you want with Sezzle Buy Now, Pay Later. The flexibility of a credit card without the interest or hidden fees.¹

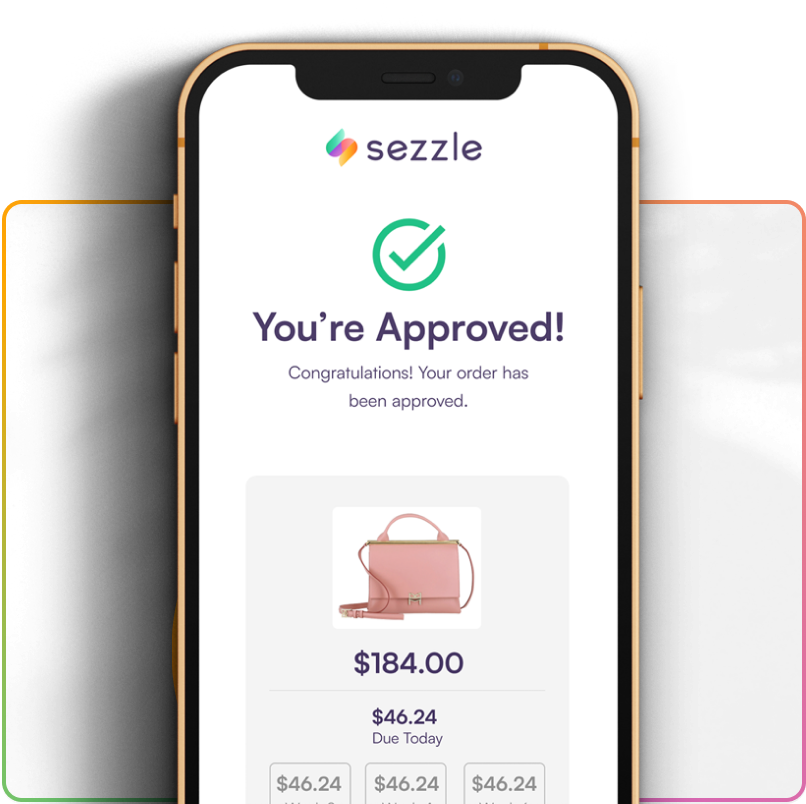

Instant Approval Decision

Sign up for Sezzle today with no impact on your credit and get an approval decision within seconds!

Sign Up

For Merchants

Offer a responsible way for customers to buy now pay later, driving increased basket sizes and incremental conversions.

Learn More

Trending Brands

Get exclusive access and deals at the top brands you already know & love.

Trending Brands

Get exclusive access and deals at the top brands you already know & love.

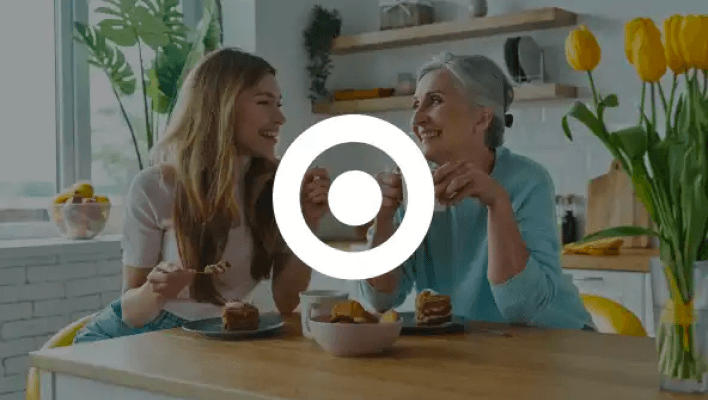

Easily Shop Online or In-Store

Download the Sezzle app, set up the Virtual Card, and start paying later at top brands like Amazon, Target, & Walmart.²

Easily Shop Online or In-Store

Download the Sezzle app, set up the Virtual Card, and start paying later at top brands like Amazon, Target, & Walmart.²

Financially Empowering the Next Generation

Financial freedom is a right, not a privilege. We’re here to help you achieve financial freedom and take control over your finances so you can build your future.

Financially Empowering the Next Generation

Financial freedom is a right, not a privilege. We’re here to help you achieve financial freedom and take control over your finances so you can build your future.

Ratings as of 5/15/25

Ratings as of 5/15/25