Unlock More Customers and Drive Incremental Sales with Sezzle

Drive significant incremental revenue by reaching untapped audiences and reducing abandoned carts–because every shopper counts.*

Flexibility: Meet Shoppers Where They are Financially

Let consumers choose the flexible payment options that align with their shopping habits and pay cycle.†

![Pay in 4. Pay in 5. Pay in 2. Pay Monthly.]()

Let consumers choose the flexible payment options that align with their shopping habits and pay cycle.†

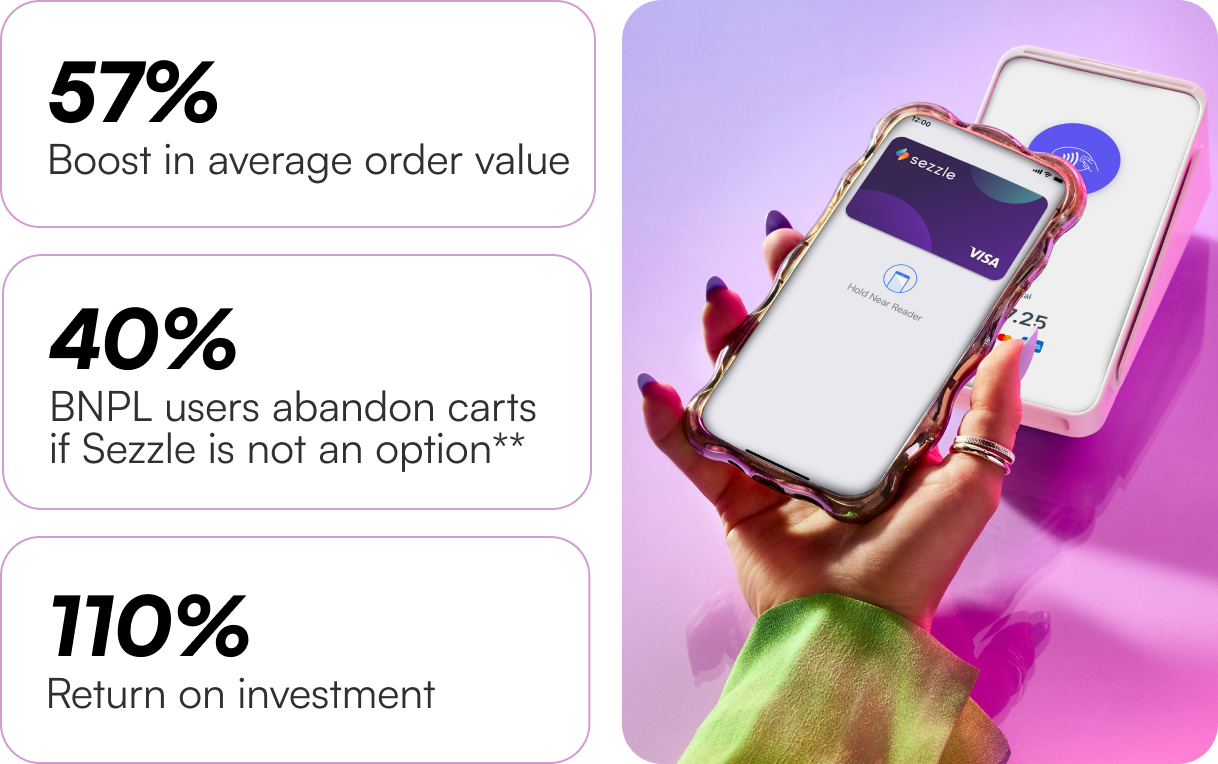

Incrementality: Boost Sales Online and In-Store

Learn more about the benefits of Sezzle from our Total Economic Impact Study with Forrester.*

Learn more about the benefits of Sezzle from our Total Economic Impact Study with Forrester.*

Accessibility: Convert More Customers

Unlock access to new, repeat shoppers, that rely on Sezzle’s flexible and secure payment options.

Unlock access to new, repeat shoppers, that rely on Sezzle’s flexible and secure payment options.

Join Thousands of Retailers + Schedule a Demo Today

![Top Brands]()

Trusted by Millions of Shoppers

![4.9 App Store. 4.7 Play Store. 4.1 Trustpilot.]()

Ratings as of 5/15/25

Ratings as of 5/15/25

Launch Seamlessly with

Plug-and-Play Integration

Plug-and-Play Integration

Questions about integrations? Contact a Sezzle Integration Expert

Read About Sezzle’s

Growth and Innovation

Growth and Innovation