Pay in 4 and Build Credit

Welcome to Sezzle, The Responsible Way to Pay. Start splitting your purchases into 4 installments over 6 weeks today.¹

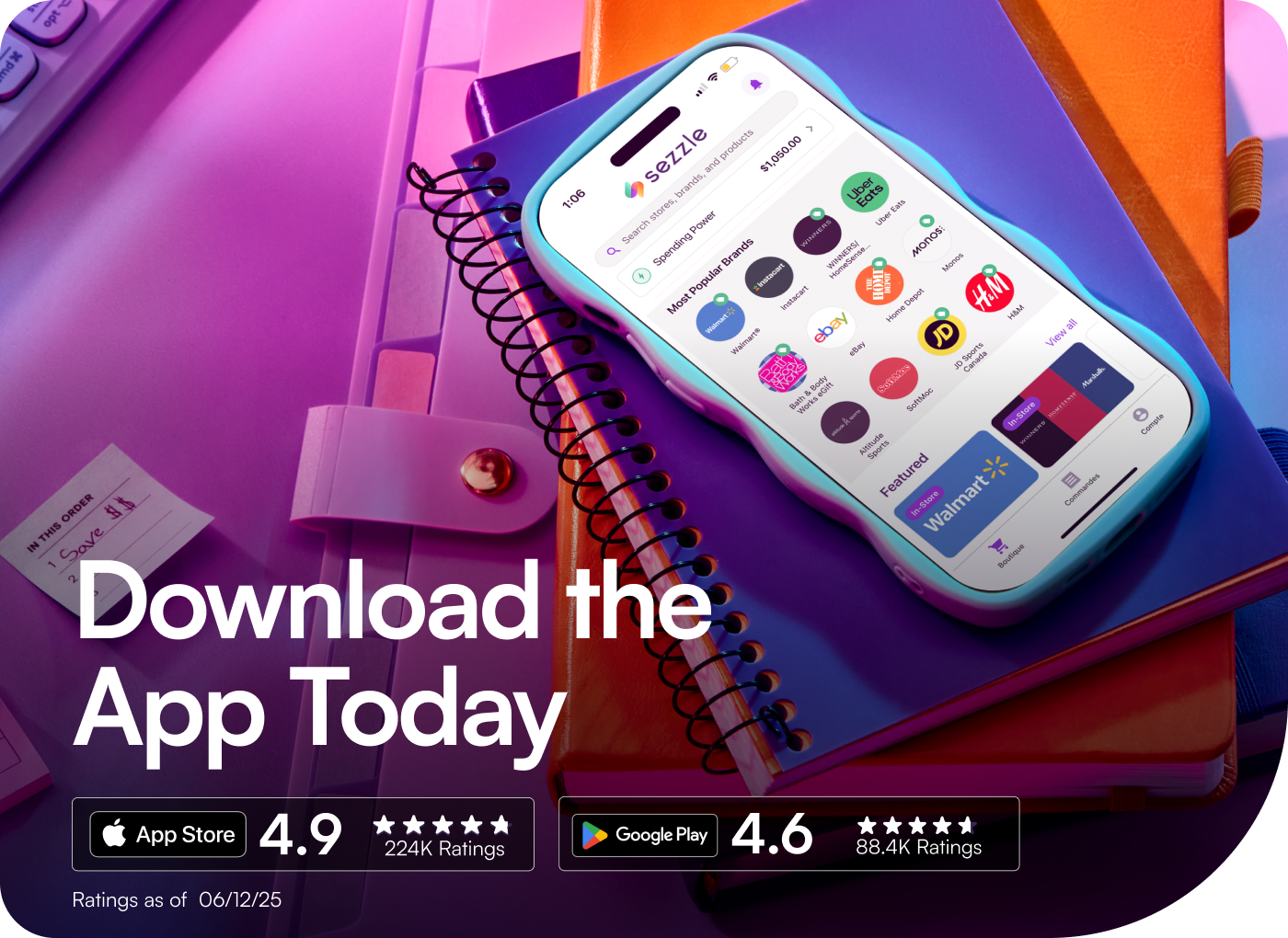

Download the App Today

By providing your phone number, you consent to receive a one-time automated SMS message from Sezzle containing a link to download our app. Message and data rates may apply.

Shop Now. Pay Later. Your Way.

Wherever you shop, Sezzle fits right in with interest-free¹ pay later options and app-exclusive perks.

Pay Later at Top Brands

Pay for your purchases over 6 weeks with 0% interest.¹

Start Shopping >

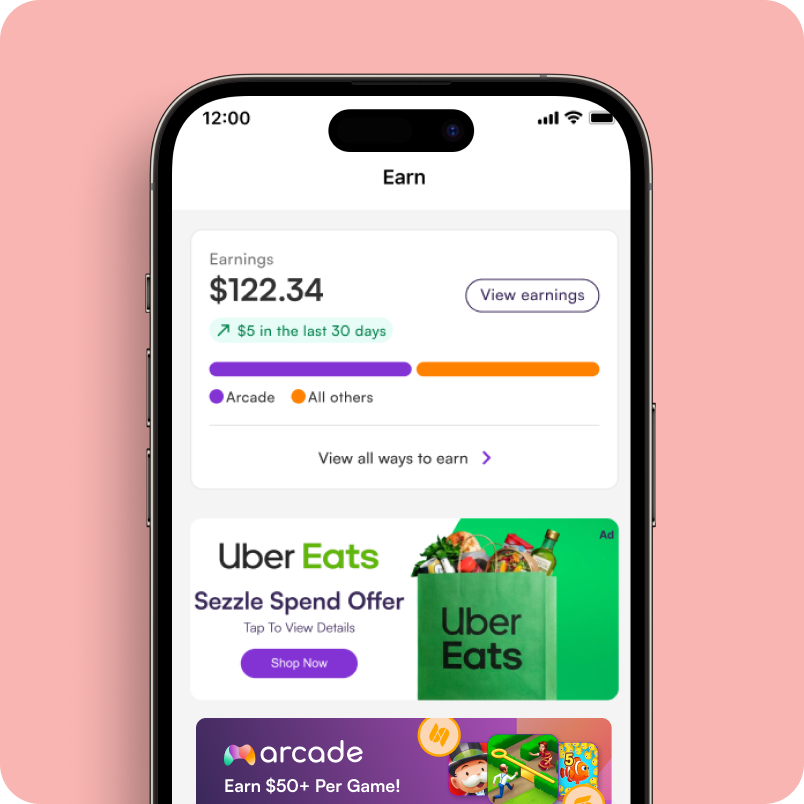

Rewards in the App

Earn Sezzle Spend to use on future purchases when you play games and more

Discover Perks >

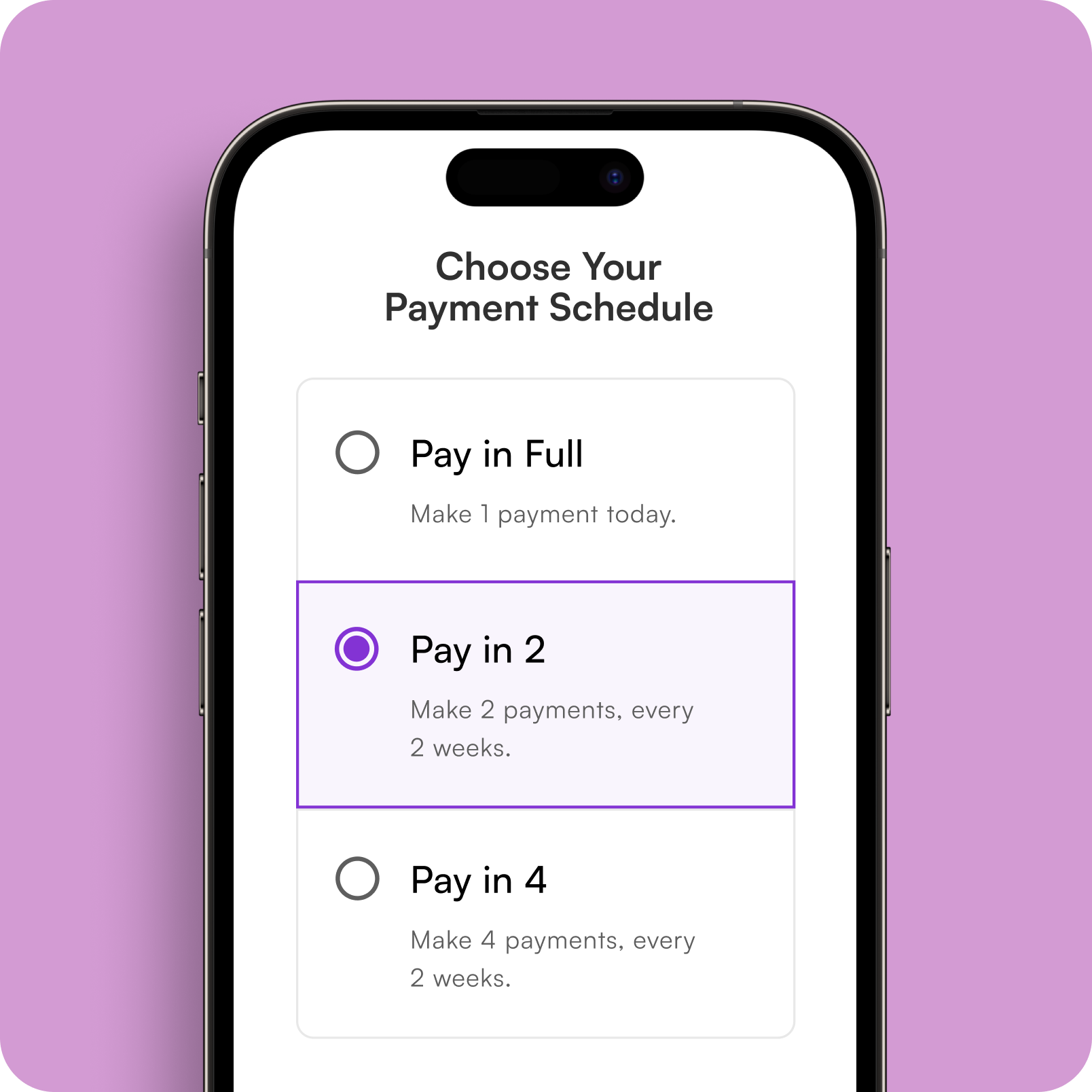

Take Control of How You Pay

From checkout to payoff, Sezzle puts you in control of how you pay.

Manage Payments >

Ratings as of 11/6/25

Ratings as of 11/6/25

Trending Brands

Get exclusive access and deals at the top brands you already know & love.

Trending Brands

Get exclusive access and deals at the top brands you already know & love.

Financially Empowering the Next Generation

Financial freedom is a right, not a privilege. We’re here to help you achieve financial freedom and take control over your finances so you can build your future.

Financially Empowering the Next Generation

Financial freedom is a right, not a privilege. We’re here to help you achieve financial freedom and take control over your finances so you can build your future.